Futa tax calculator

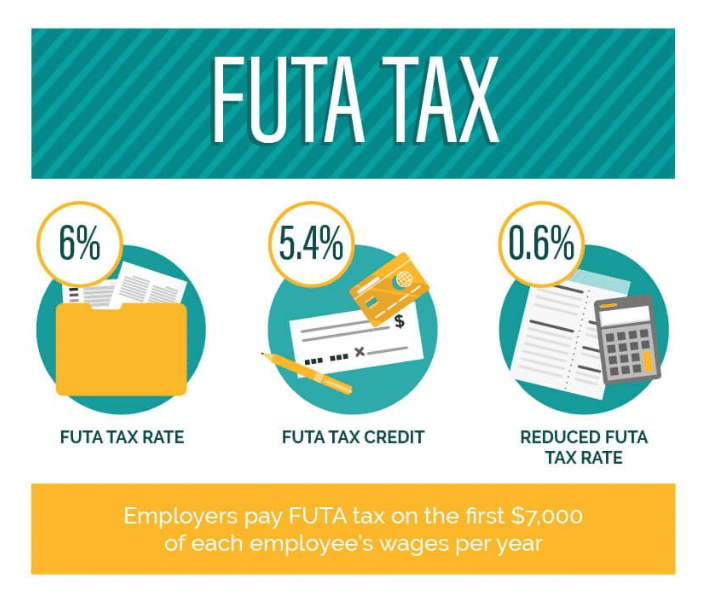

How to calculate FUTA tax. The FUTA tax rate is 6.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Using the example from Step 3 you would take the maximum 54 percent credit leaving a minimum FUTA tax of just 08 percent.

. How to Calculate the FUTA Tax. Using this example your FUTA tax for this. SUTA tax rates will vary for each state.

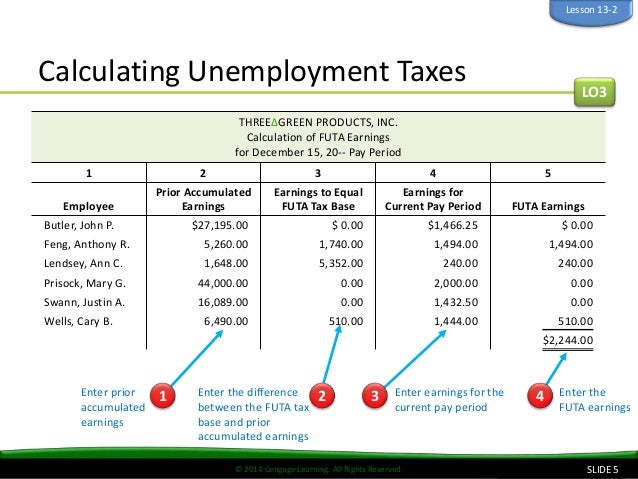

The federal tax applies to the first 7000 in wages you pay each employee during a calendar year after subtracting any exempt payments. Information about Form 940 Employers Annual Federal Unemployment FUTA Tax Return including recent updates related forms and instructions on how to file. How to calculate FUTA Tax.

For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income. If your FUTA tax liability is more than 500 for the calendar year you. Calculate the Employee Portion.

Multiply the total wages paid to your employee by the current employee rate. This 7000 threshold is called the wage base. Dec 30 2021 The FUTA tax rate is currently 60.

You can calculate your liability by adding up all eligible payments made to. Since everyone makes more than 7000 per year and FUTA tax only applies to the first 7000 earned we can calculate your companys FUTA tax liability with the following. Add up the wages paid during the reporting period to your employees who are subject to FUTA tax.

For example an employee. Employers will receive an assessment or tax rate for which they. The FUTA tax rate for 2022 is 60 on the first 7000 of wages paid to each employee during the year.

A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax minus a 54 credit. The federal FUTA is the same for all employers 60 percent. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax.

The standard FUTA tax rate is 6 so your max. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. With the Taxable Wage Base Limit at 7000 FUTA Tax per employee.

As mentioned the FUTA tax applies to the first 7000 in wages paid to each employee. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax. Federal unemployment tax only applies to the first 7000 you pay to each employee in a calendar year.

How to Calculate the FUTA Tax. Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable. Each state has a range of SUTA tax rates ranging from 065 to 68.

FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. However it is subject to a reduction of a maximum of 54 from state unemployment. Employers that paid FUTA taxable wages and UI tax in any credit reduction state even if the employer is a single-state employer.

Although Form 940 covers a calendar year you may have to deposit your FUTA tax before you file your return. Nov 15 2019 Heres how to figure your SUTA tax. These employers report the FUTA taxable.

The FUTA tax is 6 0060 on the first 7000 of income for each employee. Access The Accuchex FUTA Tax Calculator Calculate Your Estimated 2016 FUTA Tax When a state borrows UI funds from the Federal Unemployment Account FUA and does not repay it. 7000 John 2000 Paul 4000 George 13000 Wages Earned.

Futa Tax Overview How It Works How To Calculate

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

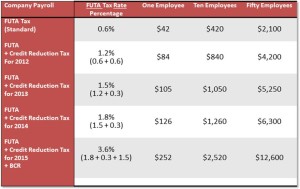

The Futa Tax Rates For California Increase For 2016

How To Calculate Unemployment Tax Futa Dummies

Futa Tax Who Must Pay How To File And Faqs

Futa Credit Reduction Tax Calculator What Is Your 2015 Futa Tax

Futa Tax Calculation Accuchex

Payroll Tax Calculator For Employers Gusto

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

What Is Futa Tax It Business Mind

The Top How To Calculate Federal Unemployment Tax

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Calculating Futa And Suta Youtube

What Is The Federal Unemployment Tax Rate In 2020

Payroll Tax Rates 2022 Guide Forbes Advisor

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Formulate If Statement To Calculate Futa Wages Microsoft Community